Welcome Friends!

Hello everyone, and welcome to another weekly hot take! Today we will discuss the possibility of a direct squeeze out of the current lows vs. another backtest on those lows. Make sure to read the full report, as it has important implications for risk management.

Precious Metals

XAUUSD

(Monthly)

A monthly close back above $1923 would be a very good sign for the bulls. So far we have broken the first blue EMA, but we are back above it, so the bulls have saved it for the time being and therefore also reduced the odds of the bears being able to regain control on the long term picture. However, the danger is not gone for the bulls, as the retest of $1923 might still fail and then lead to another lower low. In both the weekly candle and daily candle charts, this will become more clear:

(Weekly)

On the weekly chart, we can see that we have bounced off the previous ICL level with a slight undercut, which might still get retested. The EMAs have inched close to the $1923 level, which is setting up perfectly for a strong decision point to come. A powerful breakthrough will turn all the tables incredibly bullish again, and a failure at $1923 will be our warning signal that a retest or even a cycle failure is coming.

A very important twist here are the silver charts, which we will uncover later in the hot take. Let’s first have a look at the daily gold candles!

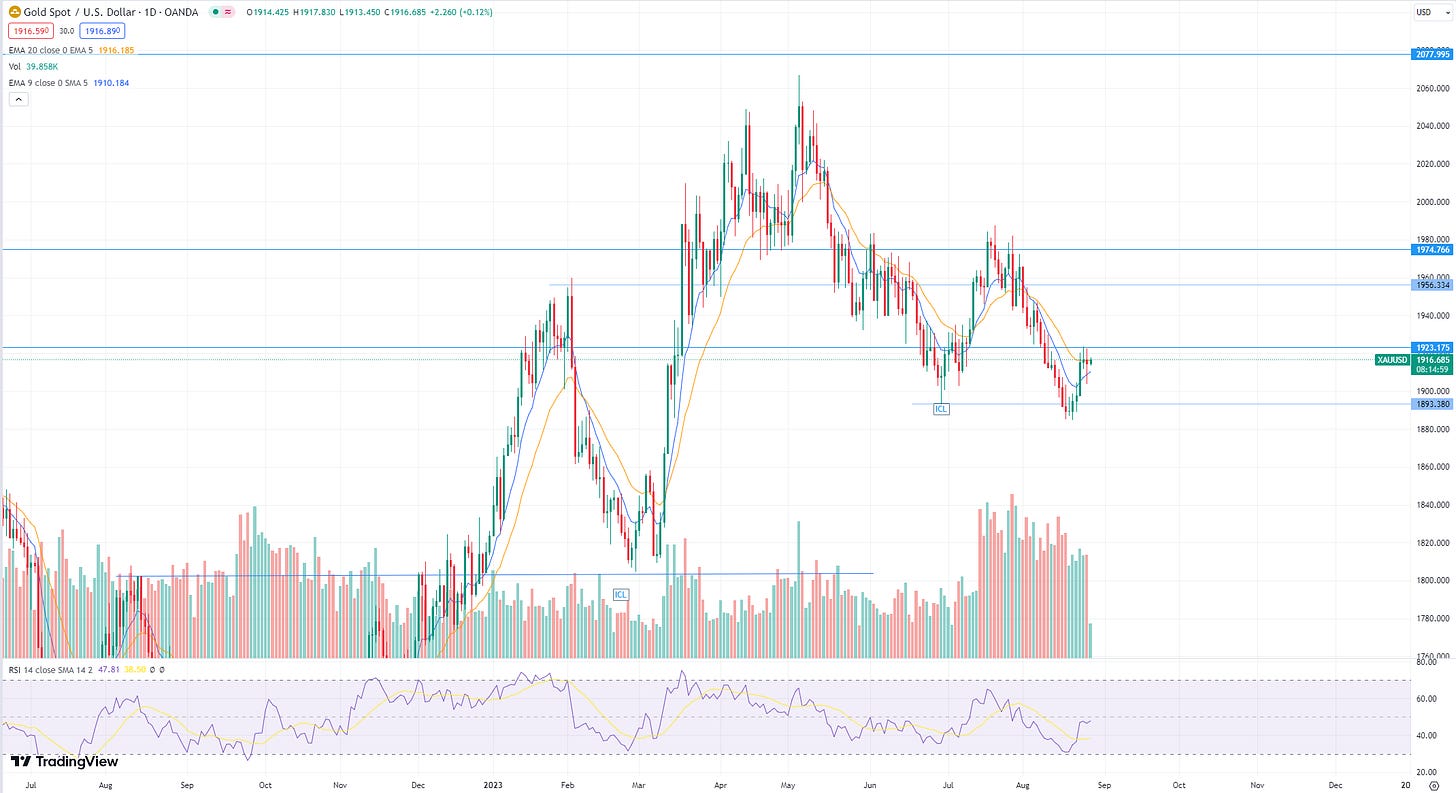

(Daily)

On the daily chart, we can clearly see that we have broken above both EMAs, which means our current cycle low is in. Therefore, we will take a bullish stance that the $1923 level will break. I expect a violent move to the upside once this happens! On the downside, we will stay alert for potential rejections at $1923.

XAGUSD

(Monthly)

When I’m looking at the monthly candles for silver, all I can think about is an extremely coiled spring here below the $25-$26 resistance zone, which, in my opinion, will be the gateway to a silver breakout. Otherwise, we are holding firmly with yet another bullish wick candle.

(Weekly)

On the weekly chart for silver, we see that we had an amazing first short covering since the low. This hasn’t provided us with a lower low, pointing to the potential of shorts being trapped here. Therefore, it is extremely likely that there will either be a retest to bail these guys out or a direct squeeze, which will be the fuel for our $25-$26 break. It's exciting to see it play here!

(Daily)

The objective is to break the downward-sloping trendline and the $26 resistance with violence! Logically, this is also the point where bears will HAVE to step in, or this will unravel as a major short squeeze.

Thank you!

If you enjoyed the weekly hot take, don’t forget to like, share, and subscribe!

Feel free to comment below with any additional questions on the price action!